Ethereum Price Trajectory: Navigating Short-Term Volatility for Long-Term Gains

#ETH

- Technical Resilience: ETH maintains support above 20-day MA despite bearish MACD, suggesting accumulation phase

- Institutional Dynamics: Whale selling and ETF outflows create short-term pressure, but strategic treasury accumulation indicates long-term confidence

- Ecosystem Growth: Ethereum's fundamental adoption as DeFi and Web3 infrastructure supports multi-year bullish trajectory despite periodic corrections

ETH Price Prediction

Technical Analysis: ETH Shows Resilience Above Key Moving Average

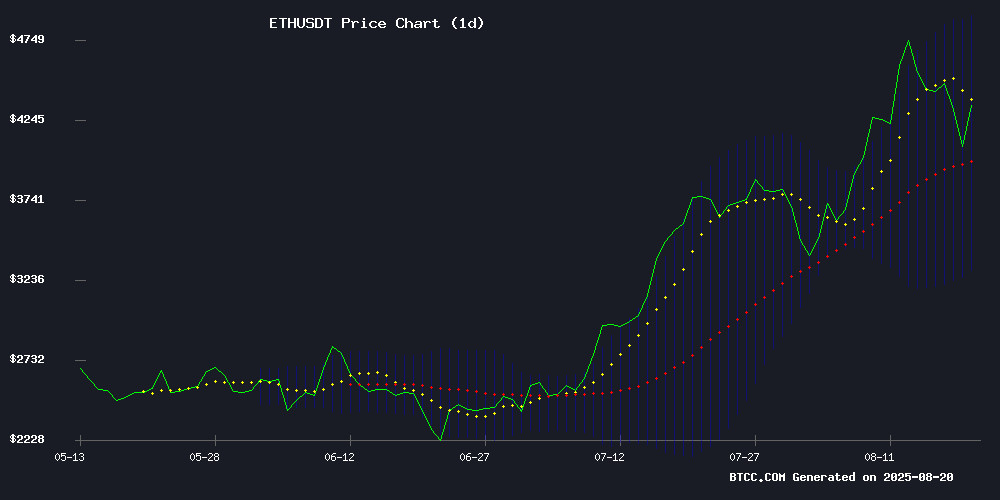

ETH is currently trading at $4,195.08, holding above the critical 20-day moving average of $4,092.68, which suggests underlying strength despite recent volatility. The MACD reading of -415.36 indicates bearish momentum in the short term, though the narrowing histogram at -90.98 shows potential for momentum shift. Bollinger Bands reveal price compression with current levels sitting between the middle ($4,092.68) and upper band ($4,889.33), suggesting consolidation before the next significant move.

According to BTCC financial analyst Michael, 'The ability to maintain above the 20-day MA while MACD shows signs of convergence could indicate accumulation at these levels. A break above $4,300 WOULD confirm bullish resumption.'

Market Sentiment: Short-Term Pressure Meets Long-Term Optimism

Recent headlines highlight significant selling pressure from Ethereum whales and institutional outflows totaling $196.6 million from ETF products, creating near-term headwinds for ETH price action. However, strategic treasury movements by entities like SharpLink Gaming accumulating over $3.1 billion in Ether suggest institutional confidence in long-term value.

BTCC financial analyst Michael notes, 'While whale distributions and ETF outflows create temporary selling pressure, the underlying ecosystem developments and institutional accumulation patterns support the technical thesis of consolidation before upward movement. The market is experiencing typical profit-taking after recent gains.'

Factors Influencing ETH's Price

Ethereum Suffers a Sharp Decline, Shaking the Crypto Market

Ethereum, the second-largest cryptocurrency by market capitalization, has experienced a significant downturn, shedding 7.3% of its value over the past week. The asset's price slid to $4,166, exacerbating losses for leveraged traders. Nearly 137,000 investors faced liquidations totaling $486.6 million, with Ethereum positions accounting for $196.8 million of that sum.

Margin traders bore the brunt of the sell-off. One notable case saw a trader's $29.6 million paper profit—accumulated from an initial $125,000 position—nearly erased during the volatility. The rapid unwind of long positions suggests mounting pressure from institutional players and large holders.

Market observers point to cascading liquidations as the primary driver of Ethereum's sharp decline. The concentrated selling from overleveraged positions created a feedback loop, with each price drop triggering further margin calls. This comes amid broader weakness across digital assets, though Ethereum's outsized role in decentralized finance makes its movements particularly consequential for the sector.

Ethereum Whales Trigger Market Sell-Off as ETH Price Tumbles

Ethereum faced intense selling pressure as large holders dumped $148 million worth of ETH within hours. The cryptocurrency slid 5% from its intraday high of $4,379, with trading activity declining 11%. Whale movements tracked by Lookonchain show three major deposits—$77.4 million to Coinbase, $57.72 million to Binance, and $12.89 million to Binance—accelerating the downward spiral.

Traditional markets mirrored the exodus. Ethereum ETFs bled $196.6 million on Monday, marking the second-worst daily outflow on record. Combined with Friday's $59 million retreat, the sector has hemorrhaged $256 million in two days. Such rapid divestment signals eroding confidence among institutional players.

The sell-off exposes Ethereum's vulnerability to concentrated whale actions. As liquidity tightens, the network must demonstrate fundamental resilience beyond speculative trading patterns. Market watchers now scrutinize whether emerging support levels can stem the bleeding.

Ethereum ETFs See $196.6M Outflow as BlackRock and Fidelity Lead Redemptions

US Ethereum exchange-traded funds faced a substantial $196.6 million withdrawal on August 18, marking the second-largest daily redemption since their launch. BlackRock's ETHA led the exodus with $86.9 million in outflows, followed closely by Fidelity's FETH at $78.4 million.

The broader Ethereum ETF market showed similar trends, with Grayscale's product shedding $18.7 million and Franklin Templeton's EZET losing $6.6 million. VanEck and Bitwise completed the picture with smaller but notable outflows of $4.8 million and $1 million respectively.

This coordinated withdrawal across major issuers suggests institutional investors may be reevaluating short-term Ethereum exposure, despite the asset's strong fundamentals and growing ecosystem development.

Ethereum Whale Longling Capital Offloads 5,000 ETH in Strategic Sale

Longling Capital, a prominent Chinese investment firm, has sold 5,000 Ethereum (ETH) worth $21.56 million, continuing its calculated strategy to capitalize on market fluctuations. The transaction, tracked via on-chain data, involved depositing the ETH to an exchange for liquidation.

The firm has demonstrated a pattern of strategic Ethereum moves since 2022, including a prior acquisition of 123,405 ETH from Binance valued at $290 million. Longling's approach involves precise timing of deposits and withdrawals to maximize profits, exemplified by a recent 70,800 ETH deposit that yielded $184 million in gains.

Analysts interpret the latest sale as profit-taking rather than a bearish signal, underscoring the whale's disciplined execution of its trading playbook.

Rollblock Casino Disrupts Online Gaming as Early RBLK Investors Eye 50x Gains

The online gambling industry is undergoing a seismic shift in 2025 as Rollblock's Ethereum-based GambleFi platform lures users away from established players like Stake.com. With over 12,000 AI-powered games and verifiable on-chain transactions, Rollblock addresses longstanding transparency issues while offering staking yields up to 30% APY.

More than $15 million in wagers have already flowed through the platform, with its revenue-sharing model allocating 30% of weekly income to token buybacks. The project's aggressive burn mechanism - permanently removing 60% of repurchased tokens - creates artificial scarcity as crypto markets enter a bullish phase.

Early adopters are positioning RBLK as one of the most compelling altcoin plays of the cycle, combining DeFi mechanics with gambling's inherent cash flows. The platform's anonymous access and live dealer experiences mirror traditional casino appeal while leveraging blockchain's auditability.

Ethereum Validator Exits Top $4B Amid Staking ETF Speculation

Ethereum's validator exit queue has swelled beyond $4 billion as staking withdrawals accelerate, signaling shifting liquidity dynamics in the world's second-largest blockchain. The queue expanded from 640,000 ETH to over 910,000 ETH within a fortnight, while active validators now number 1.08 million.

Nearly 30% of Ethereum's total supply remains locked in staking contracts, representing 35.3 million ETH. This outflow coincides with ETH's 10% price correction after failing to breach $4,800 resistance. Market observers note an intriguing divergence - while $3.9 billion seeks exit, only $1.09 billion in fresh staking demand has emerged.

Liquid staking platforms like Lido, EthFi, and Coinbase are driving the exodus. Some analysts interpret the churn as strategic repositioning ahead of potential spot Ethereum ETF approvals, with investors potentially cycling liquidity through new institutional products.

Ethereum Price Prediction: Will ETH Retest $4K Amid Rising Sell Pressure?

Ethereum's price has retreated to $4,335 after failing to sustain momentum above $4,700, marking a 4.35% daily drop. Whale profit-taking is exacerbating sell-side pressure, with traders eyeing the $4,000 support level as a critical threshold for directional bias.

Technical indicators suggest weakening bullish conviction. The Stochastic RSI at 36 reflects dwindling buying power, while resistance at $4,800 appears formidable. Market sentiment now hinges on whether ETH can defend the psychological $4,000 floor before attempting recovery.

SharpLink Gaming's Ether Holdings Surpass $3.1B Amid Aggressive Treasury Strategy

SharpLink Gaming (SBET), a Nasdaq-listed firm led by Ethereum co-founder Joe Lubin, has amassed 740,760 ETH worth $3.18 billion. The company acquired 143,593 ETH last week at an average price of $4,648, funded by $537 million in net proceeds from recent offerings. Despite the crypto market downturn, SharpLink remains committed to its aggressive digital asset strategy.

The Minneapolis-based firm trails competitor BitMine Immersion Technologies, which holds over 1.5 million ETH. SharpLink's treasury approach includes staking tokens for rewards and retains $84 million in cash for future purchases. Ethereum's price volatility underscores the high-stakes nature of institutional crypto accumulation.

Ethereum Faces Short-Term Pullback Amid Bullish Technical Patterns

Ethereum shows signs of a tactical retreat after recent consolidation, with Fundstrat's technical team anticipating a brief dip to the $4,075-$4,150 range. Analyst Mark Newton interprets this as a standard Elliott Wave correction—a common prelude to continuation patterns in bullish markets.

The projected 5-6% drawdown presents what Newton calls 'a textbook risk-reward opportunity' for accumulation. Such retracements frequently precede renewed upward momentum in crypto assets, particularly those like ETH with strong institutional adoption narratives.

Market technicians emphasize these movements represent healthy price discovery rather than structural weakness. 'This isn't a breakdown—it's the market catching its breath,' Newton observed, noting Ethereum's fundamentals remain robust despite short-term volatility.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical patterns, market sentiment, and Ethereum's fundamental adoption trajectory, here are conservative price projections:

| Year | Price Range (USDT) | Key Drivers |

|---|---|---|

| 2025 | $4,800 - $6,200 | ETF adoption recovery, Ethereum 2.0 upgrades completion |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, institutional staking growth |

| 2035 | $25,000 - $40,000 | Global settlement layer status, Web3 infrastructure dominance |

| 2040 | $45,000 - $75,000+ | Full tokenization economy, Ethereum as digital gold standard |

BTCC financial analyst Michael emphasizes that 'these projections assume continued network development and broader crypto market maturation. Short-term volatility should be expected, but the long-term trajectory remains fundamentally bullish given Ethereum's ecosystem dominance.'